When it comes to scaling your business and keeping more of what you earn, Puerto Rico is more than just a tropical paradise—it’s a strategic powerhouse. With the U.S. tax code increasingly squeezing entrepreneurs and business owners, Puerto Rico offers a unique proposition that’s impossible to ignore. If you’ve ever thought about lowering your tax burden while expanding your reach, it’s time to consider Puerto Rico. Here’s why:

1. Unmatched Tax Incentives

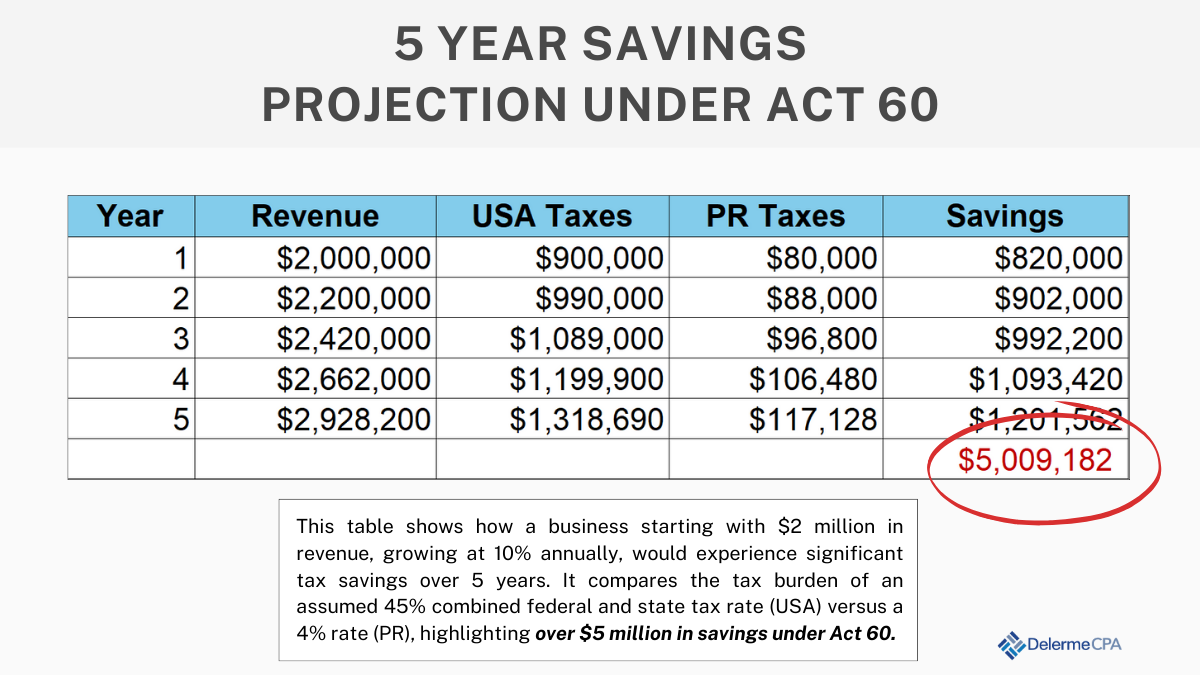

Let’s cut straight to the chase: taxes. Under Act 60, Puerto Rico offers some of the most attractive tax incentives in the world. We’re talking about a 4% corporate tax rate, zero taxes on dividends, and no capital gains tax. Compare that to the mainland, where federal and state taxes can easily eat up 30-50% of your earnings. It’s not just about saving money; it’s about reinvesting those savings into your business, your people, and your growth. The tax code here is designed to reward entrepreneurs who bring their business to the island.

You’re not just getting a better tax deal—you’re getting a smarter tax strategy. By moving your business to Puerto Rico, you’re effectively increasing your profit margins without any extra effort. Think of it as a performance booster, but for your balance sheet.

2. Strategic Location

Puerto Rico isn’t just strategically located between North and South America; it’s at the crossroads of major shipping lanes and air routes. If your business depends on importing or exporting goods, this is a logistical dream. It’s a gateway to the Americas and beyond, making it easier to expand your market reach while cutting down on shipping times and costs.

For those in service-based industries, Puerto Rico’s time zone overlaps perfectly with both U.S. coasts and Latin America. This allows you to operate in sync with major markets, offering seamless customer service and collaboration opportunities. Plus, English is widely spoken, and the U.S. dollar is the official currency, so there’s no need to worry about language barriers or currency exchange headaches.

3. Skilled Workforce and Lower Labor Costs

Let’s talk talent. Puerto Rico boasts a highly educated workforce with strong ties to the U.S. educational system. Many professionals here are bilingual, which is a huge advantage for businesses looking to serve both English and Spanish-speaking markets. Whether you need engineers, marketers, or customer service reps, Puerto Rico’s talent pool is deep and diverse.

4. Quality of Life

Let’s not forget the lifestyle. Puerto Rico offers a quality of life that’s hard to beat—beautiful beaches, vibrant culture, and a strong sense of community. But it’s not just about sipping piña coladas by the ocean. The island offers a safe and stable environment for you, your family, and your employees. Your team will thank you for the improved work-life balance. And let’s be honest, who wouldn’t want to close a big deal and then hit the beach?

5. Business-Friendly Environment

Puerto Rico is open for business. The government has made it clear that they’re committed to attracting and retaining companies that bring value to the island. The application process for Act 60 is straightforward, and with the right guidance, you can navigate it without breaking a sweat.

Moreover, the island offers a robust infrastructure that’s constantly improving. From reliable internet to modern office spaces, Puerto Rico has all the amenities you need to run your business smoothly. And let’s not forget the growing community of entrepreneurs who are already taking advantage of these benefits. Networking opportunities abound, and you’ll find yourself in good company.

Final Thoughts: Don’t Miss the Boat

Puerto Rico is more than just a tax haven; it’s a strategic move that can take your business to the next level. With unmatched tax incentives, a strategic location, a skilled workforce, and a high quality of life, the island offers a unique blend of advantages that are hard to find anywhere else.

If you’re serious about growing your business and keeping more of your hard-earned money, it’s time to consider Puerto Rico. The opportunity is here, the advantages are clear, and the time to act is now. Don’t miss the boat—reach out, and let’s discuss how you can make Puerto Rico the next chapter in your business success story.